domin_domin/E+ via Getty Images

This article was coproduced with Mark Roussin.

No doubt, you’ve heard things being described as “fit for a king” before. It means the best of the best – something a monarch would be proud to own.

That’s exactly the kind of stock that Mark Roussin, CPA and I look for – especially when they pay dividends. In fact, roughly 99.9% of our articles are centered around dividend-paying stocks.

You’ll often find us discussing dividend aristocrats as a result. As of June 1, there were 65 of those stocks, meaning there were 65 that met the following criteria:

- Be an S&P 500 member

- Have 25+ years of consecutive annual dividend increases

- Have a market cap of $3 billion or more.

That’s quite the collection, to say the least. Not only paying a dividend, but INCREASING it for 25+ years is an impressive feat.

But today, we’re taking things a step further still to look at dividend kings – the highest honor to hold within the dividend kingdom.

There’s only one requirement to gain that title, though it is a doozy: Pay 50 years or more of rising dividends – in a row. No mulligans!

Even so, there are only 44 such stocks out there, with some of the newest ones being:

- PepsiCo (PEP)

- Abbott Labs (ABT)

- Kimberly-Clark (KMB).

- Federal Realty (FRT) – the only REIT king!

But we don’t just want “any old” dividend king (as if there is such a thing). We want to take a look at three of the best and brightest: the top dividend kings to buy.

Dividend King No. 1 – Lowe’s Companies

To begin, let’s discuss a favorite dividend stock of mine as of late: Lowe’s Companies, Inc. (LOW). It may be second fiddle in the home improvement duopoly to Home Depot (HD), but it’s still worth talking about.

For years, Home Depot was a well-oiled machine that easily outpaced Lowe’s in terms of sales and efficiency. And its balance sheet was no slouch either.

However, Lowe’s has managed to close the gap more recently. Since taking over in July 2018, CEO Marvin Ellison has put his fingerprints all over this company and it shows.

Ellison’s resume includes time served as CEO at JCPenney and a decade working in a senior-level operations role at… wait for it… none other than Home Depot. Mr. Ellison knew exactly what made that competitor tick, and he wasn’t shy about implementing that strategy when he transferred to Lowe’s.

The result is an improved supply chain, a strong online presence, and a strengthened relationship with professional customers – an area HD has dominated over the years. In addition, Lowe’s stores have been revamped to focus on their most popular items, reduce overlap, and rid themselves of slow-moving inventory.

And the timing couldn’t have been more perfect. Because these changes really started kicking in right around when home improvement began to boom in 2020 as the lockdowns forced people to rethink their to-do lists.

The last two years were extremely strong for the company. Though, admittedly, 2022 has proven to be different thus far. A slowing real estate market combined with workers returning to the office have helped send shares of Lowe’s down significantly.

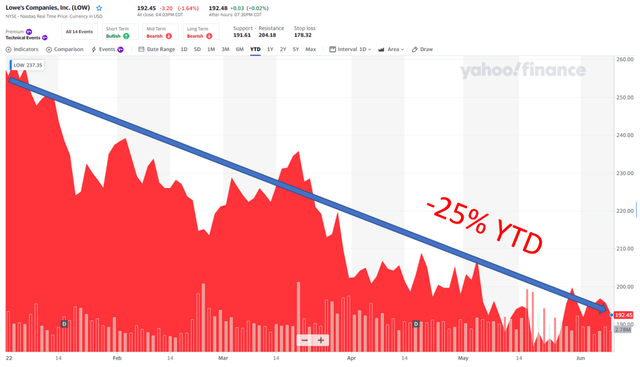

They’re down 25% year-to-date, which isn’t as bad as it could be considering how Home Depot is down 27%.

Yahoo Finance

Both companies are coming off poor quarters with lower revenue amidst higher inflation costs and the slowing real estate market. That’s why LOW management now expects 2022 revenue to be flat year-over-year.

Home Depot, meanwhile, has guided revenue growth of just 3%.

Recession talks have been at the forefront of most investors’ minds as of late, and rightfully slow. Record-high inflation, record-high fuel prices, supply chain issues are bad enough. But then you also have to add in the Federal Reserve increasing interest rates and selling off assets that have been sitting on its overinflated balance sheet.

The latter may be necessary. But it’s a headwind for consumers and many businesses alike nonetheless, on top of the other headwinds listed.

But here’s a bit of comfort to consider…

Lowe’s actually fared quite well over previous recessions. And given the shape it’s in today – which is arguably the strongest it’s ever been – it should be no different this time around. Lowe’s should be able to weather another downturn just fine.

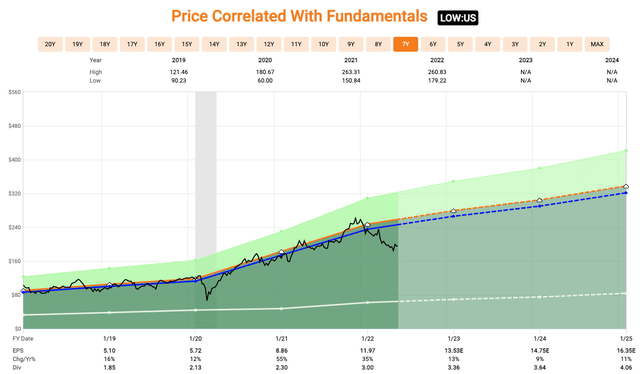

Shares currently trade at $192. And analysts expect next year’s earnings to come in at $14.75. As such, the stock is trading at a forward price-to-earnings multiple of 13x.

Looking at the past five years, it’s traded at an average P/E of 19.6x.

Fast Graphs

In terms of payouts, Lowe’s has a very strong dividend track record. Obviously. It wouldn’t be on the Dividend Kings list otherwise.

But to be specific, the company has increased its dividend for 58 years and counting. And today, it’s well covered by a low payout ratio of 26%.

Over the past five years especially, Lowe’s has increased its offering at a very strong clip: an average 18%. Yet that’s going to move higher still thanks to a recently announced 31% hike.

That absolutely exudes corporate confidence – just one more reason why we believe Lowe’s will be a great investment for the long-term.

Dividend King No 2 – Johnson & Johnson

Our next dividend king is Johnson & Johnson (JNJ), a stock that’s actually up on the year. Investors want defensive names to combat volatility and high inflation, and JNJ provides exactly that.

It’s been around for decades so it has plenty of experience guiding through slower economic times. So it has the ability to perform well in any given economic backdrop.

Slow, paused, or fast, consumers still have a need for JNJ’s type of products.

Here are just a few it has to offer:

JNJ website

Band-Aids, Tylenol, Benadryl, Listerine, Neutrogena… All these items are used regardless of whether the economy is growing or slowing.

On the year, shares are up 3.5%. Which isn’t too surprising. The company has been as steady as they come over the years in terms of stock performance and dividends.

Yahoo Finance

The company currently operates in three segments:

- Consumer health

- Pharmaceuticals

- Medical devices.

The consumer health segment is its traditional area and the most consistent grower. Not the fastest particularly, but the most consistent.

The pharmaceutical and medical device segments on the other hand, are more fast-growing. The first of those two provides over 50% of all JNJ sales.

Those provide compelling reasons to buy into this stock. But so does the company’s pending break-up, believe it or not. That has the potential to unlock value for JNJ.

In case you didn’t know, Johnson & Johnson is in the process of spinning off its consumer health segment. Admittedly, this is mainly to separate itself from the large number of ongoing lawsuits against it.

But this will also allow it to give more attention to its pharmaceutical and medical devices segments, potentially unlocking even more value.

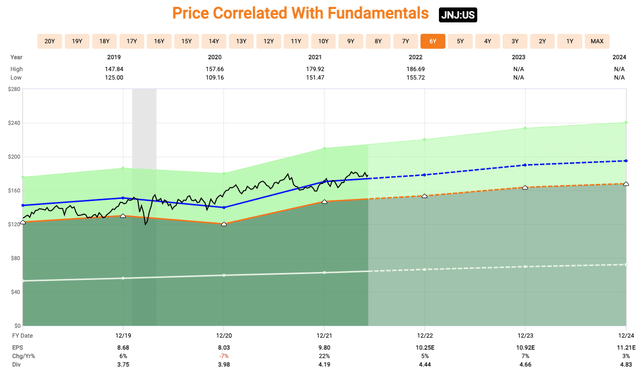

Shares of JNJ currently trade hands at $177. Analysts are expecting it to have earnings per share (‘EPS’) of $10.92 next year. So shares are trading at a forward P/E of 16x.

Looking at the chart below, shares have traded at an average P/E of 17.4x over the past five years.

Fast Graphs

In terms of the dividend, JNJ has paid one for 59 consecutive years now. The company has a five-year growth rate of 6%.

Again, JNJ is about as consistent as they come. It will be interesting to see how the spinoff plays out, but I believe it will be a positive for the company as a whole moving forward.

Dividend King No. 3 – 3M Company

The final Dividend King we’ll look at today is 3M Company (MMM)… which has been in the news this year for many of the wrong reasons. Maker of the popular N95 mask, it did very well during the pandemic, selling MILLIONS of them.

But fast-forward to 2022, and 3M has been marred by legal troubles regarding ear plugs sold to US military personnel. The claim is that they’re faulty.

A court in Florida awarded veteran James Beal a victory in his suit against 3M for that very product. The company was ordered to pay $77.5 million based on his claim of having hearing damage from wearing them.

As of May, the same Florida courthouse had more than 290,000 claims over the same issue. This poses a huge legal threat to the company moving forward, which is why shares have been under pressure this year.

Thus far, 16 cases have been heard, in which the company has won six of those and is appealing the other 10.

The settlement amount in the end will be large. We fully recognize that. But investors need to put things into perspective…

3M is an industrial giant with a strong balance sheet. Like Johnson & Johnson over the years, it’s had its fair share of legal battles. It comes with the territory and is nothing new.

As an investor, you have to try and decipher if you think the legal troubles ahead are already reflected in the stock price. As you do, consider the selloff we saw when news of the litigation was announced a few months back.

Regardless, 3M has still managed to turn respectable results even in the midst of our current economic mess. Organic sales rose 2% in the prior quarter, though adjusted EPS was down 10% due to higher fuel costs and the like.

But the company boasts an A+ rated balance sheet. So once some of these “transitory” issues start to improve, we could see a direct result to 3M’s bottom line.

Another thing to note is that China is beginning to ease its Covid restrictions. This should have workers returning to its Shanghai facilities, which in turn will help improve 3M’s supply chain woes.

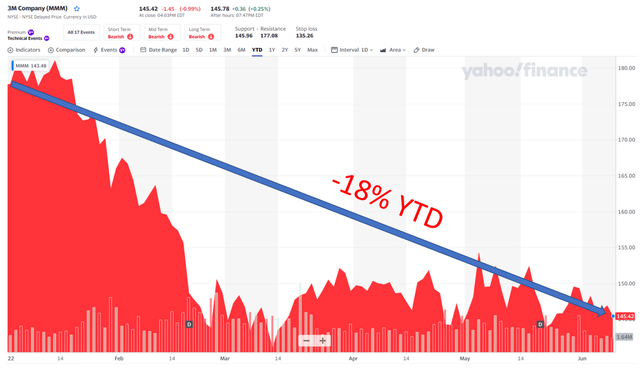

On the year, shares of MMM are down 18%, having fallen hard after the legal announcement earlier in the year.

Yahoo Finance

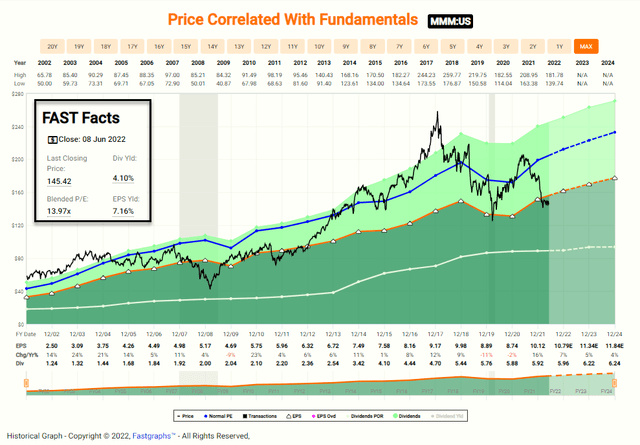

The stock currently trades at $145. Looking at the FAST Graph chart below, we can see analysts expect next year’s earnings at $11.34. This means MMM is currently trading at a forward earnings multiple of 12.7x.

Over the past five years, its average P/E has been 19.6x, suggesting shares are extremely undervalued based on this one metric.

MMM currently yields a dividend over 4%, which is quite high for them. The payout ratio is at 59%, so investors should keep an eye on that as the years go on.

The company has increased the dividend for 63 consecutive years with a five-year growth rate of 5%.

If you believe we’re headed toward a recession and that the worst of the legal troubles are already priced into the stock… then shares of MMM could provide a great buying opportunity at current levels. In the past, industrial plays like MMM have performed well during slowing economic periods.

Fast Graphs

In Closing…

I must always finish any Dividend King article with this quote from the legendary value investor, Benjamin Graham,

“Paying out a dividend does not guarantee great results, but it does improve the return of the typical stock by yanking out at least some cash out of the manager’s hands before they squander it our squirrel it away.”

Although many academics claim that it shouldn’t matter to shareholders how much of its net income a corporation pays out in dividends, many argue that dividends really do matter with respect to shareholders’ total returns. I am certain that Graham would have argued the point as he wrote (in The Intelligent Investor):

“One of the most persuasive tests of high-quality is an uninterrupted record of dividend payments going back over many years.”

He also explained in The Intelligent Investor (Chapter 20) that,

“…the margin of safety is always dependent on the price paid.”

And …

“…by definition, a favorable difference between price on the one hand and indicated or appraised value on the other. That difference is the margin of safety.”

All three of these Dividend Kings represent sound entry points and I am adding these to my investment portfolio. As you hear me often explain,

“The safest dividend is the one that’s just been raised”.

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in low, mmm, JNJ over the next 72 hours.